Bookkeeping

Total sales are calculated by adding: a cash sales and cash received from debtors b. credit sales and cash received from debtors c. cash sales and credit sales d. cash sales and credit purchases

Content

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Being able to differentiate between the different types of revenue is vital for proper accounting and reporting. Sending and tracking your invoices automatically reduces human errors – which we tend to underestimate and reduces cash flow problems. By scheduling automatic reminders, you’ll be able to keep the process under control.

- Free cash flow is important because it tells shareholders and potential investors how much cash is available for dividends, asset purchases, or debt repayment.

- Given the vital importance of cash flow in running a business, it is in a company’s best interest to collect its outstanding accounts receivables as quickly as possible.

- Managers, investors, and creditors see how effective the company is in collecting cash from customers.

- Regardless of the method, you’re using here, it will help you get an idea of where you stand.

- On February 8, you write a check for $9,500 in payment of the bill you receive from Ash.

Therefore, this must be recorded not as actual income but as a current liability. In this case, you add the number of days of the month to your DSO. When moving on to the next month, you subtract your monthly gross sales from your accounts receivable. Accounts receivable can be a little fun—after all, it’s all about raking in your hard-earned dough. Accounts payable (often called A/P), on the other hand, focuses on the unpaid bills of the business—that is, the money you owe your suppliers and other creditors.

Wrapping Up: Increasing Sales Revenue

The collection of a $700 account beyond the 2 percent discount period will result in a a. The total sales equal the amount of cash sales made and the amount of credit… List cash inflows from investments and long-term assets listed on the balance sheet. These items include sales of equipment or property, sale of investments, sale of debts, sale of equity and collection on loans or other long-term debt.

Estimate uncollected accounts by comparing payments received to total revenue for the accounting period. Subtracting payments received from total revenue should give you uncollected payments. Recognized revenue is simple; it is recorded as soon as the business transaction is conducted. Once the sale has been completed, you can record it — all of it — in your financial statements. An accounts payable aging report is a good cash management tool that should be prepared periodically.

– Account Receivables Automated tools for DSO calculation

If so, be sure they are on your list of outstanding checks this month. If a check is several months old and still has not cleared the bank, you may want to investigate further. Compare the deposits listed on your bank statement with the bank deposits shown in your cash receipts journal. On your bank reconciliation, list any deposits that have not yet cleared the bank statement. Look at the bank reconciliation you prepared last month. Did all of last month’s deposits in transit clear on this month’s bank statement?

Days payable outstanding is a ratio used to figure out how long it takes a company, on average, to pay its bills and invoices. Credit sales are payments that are not made until several days or weeks after a product has been delivered. The content provided on accountingsuperpowers.com and accompanying courses is intended for educational and informational purposes only to help business owners understand general accounting issues. The content is not intended as advice for a specific accounting situation or as a substitute for professional advice from a licensed CPA.

What Is Days Sales Outstanding (DSO)?

Cash sales information can be found in the “accounts receivable” column of some financial statements. However, some accounts receivable don’t represent cash sales, but rather cash owed by customers. Most American financial statements track receivables on an accrual basis, meaning that transactions are recorded when the sale is made, not when cash is received.

- In general, small businesses rely more heavily on steady cash flow than large, diversified companies.

- With consumer goods and services, the credit card has turned most retailers’ sales into cash sales.

- In this case, there are no accrued taxes so the income tax expense is the same as cash paid for income taxes.

- To identify the financing activities, the long‐term liability accounts and the stockholders’ equity accounts must be analyzed.

- For example, we already know that AAA Manufacturing Service’s operating cash flow is $1.1 million.

- A shortage could be the result of theft, or it could simply result from your failure to record a special transaction, such as an expense you paid in cash—but without a cash sheet, you’ll never know.

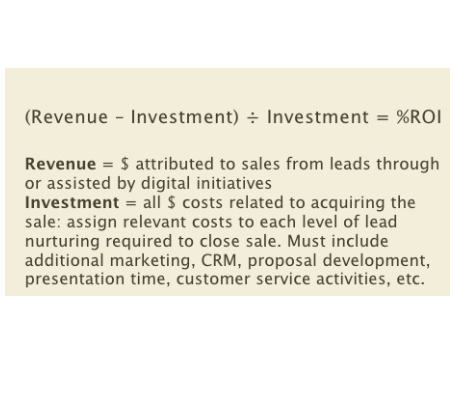

Notably, Sales Revenue includes all money earned by a business during a given period—regardless of whether or not that money is actually received by the company. That’s one of the biggest differences between Sales Revenue and Cash Flow, which includes only the cash that flows into a business’ accounts. This result means Coca Cola generated 33% operating cash flow for every dollar of revenue earned in 2021.

If a client overpays or a credit sales note is issued, this needs to be linked to an invoice for the calculation of DSO to be accurate. Thanks to AR automation cash application can be automated if payments are made via the payment portal. The monthly ledger sheet should start with a balance forward, which is the ending balance from the previous month. If your ledger sheets will not be doubling as your customer statements, you don’t need to start a new sheet every month. Just keep a permanent ledger for each customer that maintains a running total of the customer balance.

How do you calculate cash sales and credit sales?

To calculate total sales, you need to multiply the number of goods sold by the selling price for these items. To start calculating credit sales, determine the cash received. Once you have these figures, determine credit sales by reducing total sales by the amount of total cash received.

This method is most accurate as it accommodates for changing product prices as well as all cash sales. If you want a total for annual or quarterly credit sales, you can simply start recording a credit sales amount at the beginning of that period. Then, each time you update accounts receivable, you can add to the sale amount to your credit sales amount for that period.Remember that sales tax is included in credit sales amounts. Entries made in the sales and cash receipts journal are also totaled at the end of the month, and the results are posted to the accounts receivable account in your general ledger. If they aren’t the same, you can tell that you made an error somewhere along the line.

Should Sales Returns Be Deducted From Total Revenue?

The metric takes all of the cash receipts in the test period and divides it by the billed sales for the same period. It’s important that the investor-analyst aligns these two data points. In other words, the analyst should examine the billed sales and determine how much money was received from those same billed sales.

Free cash flow balances can also drive business decisions such as investments or expansion. The accounts receivable turnover ratio measures the number of times a company collects its average accounts receivable balance in a specific time period. In many businesses, the days sales outstanding number how to find cash sales can be a valuable indicator of the efficiency of the business and the quality of its cash flow. If the number gets too high, it could even disrupt the normal operations of the business, causing its own outstanding payments to be delayed. In any case, cash delayed is cash lost to your business.